Need to find “car dealerships near me”? Look no further. This guide will help you locate top local dealerships, provide tips for scoring the best deals on cars, and offer insights on financing options and maintenance services. Cut through the clutter and drive off with confidence from the dealership that best fits your needs.

Key Takeaways

- Local car dealerships offer a diverse range of vehicles, competitive pricing, and flexible financing options, facilitating a seamless car buying experience for consumers.

- Resources like Kelley Blue Book and dealership websites provide vital information for vehicle comparison and price research, enabling potential buyers to make informed decisions from the comfort of home.

- Financing options, including auto loans and leases, along with certified pre-owned programs, make vehicle ownership more accessible and provide peace of mind to consumers.

Discover Local Car Dealerships: Find the Perfect Vehicle in Your Area

Your journey to find the perfect car often starts in your neighborhood. Local car dealerships present numerous options, simplifying the process of finding a vehicle that fits your budget and needs. Think of dealerships like the ones in Akron, Ohio, and other parts of California, offering a wide array of vehicles, from sedans and SUVs to trucks and convertibles.

Partnering with trusted dealerships offers several advantages, including:

- A diverse selection of vehicles

- Competitive pricing

- A no-pressure sales atmosphere

- Flexible financing options

This ensures a seamless and enjoyable car buying experience.

Top Brands and Models Available Near You

Your quest for the ideal car entails exploring diverse options. Local car dealerships provide a rich variety, featuring a broad spectrum of vehicle brands and models to suit various preferences and needs.

Whether you’re a fan of Ford’s ruggedness, partial to Toyota’s reliability, charmed by Chevy’s charisma, or drawn to Dodge’s daring, there’s a car out there with your name on it. Dealerships like Integrity Auto Credit in Akron, Ohio, offer a comprehensive selection of models from these and many other well-known manufacturers, ensuring that you find the perfect vehicle for your lifestyle.

Participating Dealers: Trusted Partnerships and Services

Selecting a trustworthy dealership is as fundamental as picking the perfect car. Reputable dealerships extend a variety of services including competitive pricing, relaxed sales environment, and adaptable financing options.

In addition to their standard offerings, these dealerships also provide a variety of additional services, such as auto finance and test drive scheduling. This broadens the car buying experience, providing customers with a one-stop-shop for all their automotive needs. To top it all, they’re backed by numerous positive customer reviews, attesting to their commitment to quality service and customer satisfaction.

Search and Compare Vehicles: Tips for Finding the Best Deals

After you’ve shortlisted your favored dealerships, the next step involves delving into the details of securing the best car deals. This involves a combination of negotiation strategies, thorough research, and leveraging dealership competition to secure the best prices.

The key is to focus on the purchase price of the vehicle, rather than on the monthly payments. This can result in more significant savings over time. It’s also essential to be ready to walk away if the dealer does not meet your price expectations, demonstrating that you are not desperate for a deal.

Online Resources: Research and Shop from Home

In the current digital age, the convenience of researching and shopping for vehicles from home is at your disposal. Online resources like Kelley Blue Book, Edmunds, and CarMax offer a wealth of data and tools to help you make an informed decision.

These platforms allow you to:

- Compare prices

- Explore vehicle specifications

- Connect with sellers directly

- Use features like live chat or virtual assistance

With these resources at your fingertips, finding the perfect car has never been easier, regardless of your preference for metric and imperial units.

Dealer Websites: Access Detailed Information and Listings

Although online resources are advantageous, the usefulness of dealer websites shouldn’t be underestimated. These platforms provide comprehensive information about each vehicle, including specifications, features, and pricing. They also offer multiple photos and videos of vehicles, giving you a better sense of their condition and appearance.

Dealer websites serve as a digital showroom, allowing you to explore each vehicle in detail before making a visit. This empowers you to make an informed decision and ensures that your dealership visit is productive and enjoyable.

Financing and Leasing Options: Making Vehicle Ownership Affordable

With the perfect car found, your next step is to contemplate the financing options. Most local dealerships offer auto financing and leasing options which cater to various budgets and preferences.

These options make vehicle ownership more affordable and accessible. Whether you prefer the long-term commitment and ownership associated with auto loans or the lower monthly payments and shorter commitments of leasing, there’s an option out there that suits your needs.

Auto Loans: Flexible Terms and Interest Rates

Auto loans offer a long-term solution to vehicle financing. These loans come with flexible terms, usually ranging from 36 to 84 months, catering to different buyer preferences and budget constraints.

Interest rates on auto loans are greatly influenced by the borrower’s credit score, with those having higher scores typically securing lower rates. Moreover, some lenders even offer the option to prequalify for an auto loan without impacting the borrower’s credit score, allowing for a preview of potential interest rates.

Leasing: Lower Monthly Payments and Shorter Commitments

For those who prefer lower monthly payments and shorter commitments, leasing is a viable option. When you lease a car, your payments cover only the vehicle’s depreciation, resulting in lower monthly costs.

Leasing also allows individuals to drive a new car every few years, providing a hassle-free way to keep up with the latest models. Plus, at the end of the lease, the lessee is not responsible for reselling the vehicle, eliminating concerns about depreciation and resale value.

Pre-Owned Cars: Quality Used Vehicles at an Affordable Price

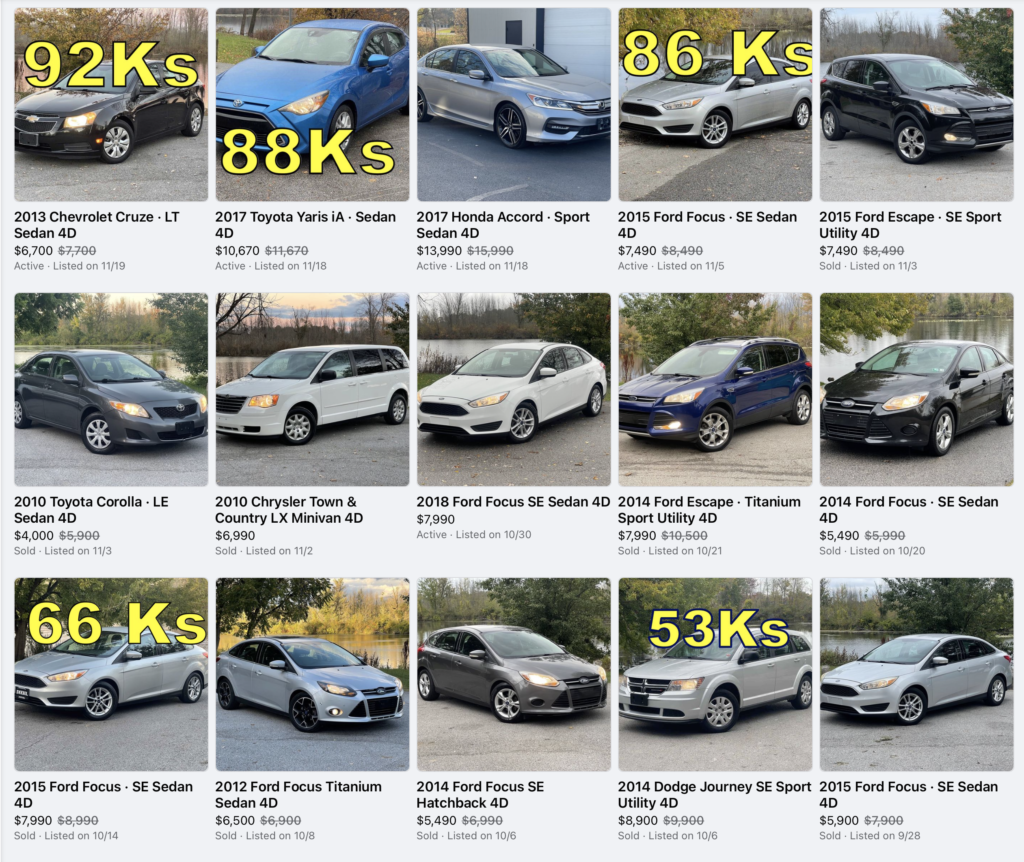

For those working within a tight budget, pre-owned cars serve as an excellent choice. These vehicles offer significant savings over new vehicles, making them highly affordable.

In addition to the cost savings, pre-owned cars also depreciate slower after the first year, representing a better investment value compared to new cars. Plus, with dealerships conducting rigorous multi-point inspections, you can rest assured that you’re getting a quality vehicle.

Certified Pre-Owned Programs: Added Peace of Mind

If you’re concerned about the quality of used cars, consider opting for certified pre-owned (CPO) vehicles. These vehicles are often still under factory warranty and include an additional extended warranty, assuring you of ongoing protection.

CPO vehicles also undergo a rigorous inspection and reconditioning process, ensuring that they meet high-quality standards. So, you get the affordability of a used car with the added peace of mind of a new one.

Tips for Buying a Used Car: What to Look for and Ask

Now that you’ve decided to buy a used car, it’s essential to know what to look for and what questions to ask. Before making a purchase, you should request to view the vehicle’s history report to verify a clean accident history.

During the test drive, pay attention to the following:

- Noise levels

- Suspension comfort over speed bumps

- Vehicle performance at different speeds

- Brake responsiveness

- Smoothness of gear shifting

This will help you make an informed decision and ensure that you’re getting a quality vehicle.

Auto Maintenance and Repair Services: Keep Your Car Running Smoothly

The purchase of a car doesn’t signal the end of the journey. Regular maintenance and prompt repairs are essential to ensure your car runs efficiently.

Many local dealerships offer a range of maintenance services, catering to a wide range of auto service needs. So, whether you need:

- a simple oil change

- a tire rotation

- a brake inspection

- an engine tune-up

- a transmission repair

- a complex repair

your local dealership has got you covered.

Routine Maintenance: Oil Changes, Tire Rotations, and More

Regular maintenance is essential to maintain your vehicle’s performance and longevity. This includes routine services like oil changes, tire rotations, and brake cleanings and adjustments.

By keeping up with these routine maintenance tasks, you can ensure your vehicle remains in peak condition and extends its lifespan. Plus, regular maintenance can also help you identify and address potential issues before they become major problems.

Repairs and Parts: Trustworthy Service and Genuine Accessories

When it comes to repairs and parts, it’s important to trust only reputable service centers. These centers offer high-quality service and use genuine parts to ensure your vehicle’s reliability and longevity.

Moreover, many dealerships provide easy online scheduling for service appointments and parts ordering, making vehicle maintenance even more convenient.

Test Drive Tips: Make the Most of Your Dealership Visit

A test drive forms an integral component of the car buying process. It’s your opportunity to see how the car performs and whether it meets your needs and expectations. Therefore, it’s important to make the most of your dealership visit and test drive.

One tip is to drive potential vehicles back-to-back on the same day to make proper comparisons. It’s also a good idea to bring a friend along for an extra pair of eyes and ears during the test drive.

Prepare a Checklist: Know What to Look for During the Test Drive

Before you hit the road, it’s wise to prepare a checklist of things to look for during the test drive. This ensures you conduct a thorough and meaningful test drive.

Your checklist should include things like:

- Inspecting the vehicle’s doors for ease of operation

- Testing all lights and mechanical features

- Checking the vehicle’s interior for functional warning lights, signals, climate control, seat belts, and doors.

Ask Questions: Get the Information You Need from Sales Representatives

During your test drive and dealership visit, don’t hesitate to ask questions. Inquiring about the vehicle’s options, powertrains, and advanced technology can help you make an informed decision.

Don’t be shy about asking for a demonstration or explanation of any advanced technology or special features in the vehicle. After all, you want to ensure you’re equipped to use them effectively.

Summary

In summary, the journey to finding the perfect car involves several steps, from discovering local car dealerships to exploring financing options, test driving potential vehicles, and ensuring proper maintenance. However, armed with these insights and tips, you’re now well-equipped to navigate the process smoothly. So, buckle up and get ready for an exciting ride to vehicle ownership.

Frequently Asked Questions

What are some of the top brands available at local car dealerships?

Local car dealerships offer a range of top brands like Toyota, Honda, Ford, Chevy, Dodge, and Nissan, providing a diverse selection for customers.

What are some tips for negotiating the best deal at a car dealership?

When negotiating at a car dealership, focus on the purchase price rather than the monthly payments and be prepared to walk away if the dealer doesn’t meet your price expectations. This approach can help you secure the best deal.

What are some benefits of leasing a car?

Leasing a car can lead to lower monthly payments, provides the opportunity to drive a new car every few years, and removes worries about depreciation and resale value.

What are some tips for buying a used car?

When buying a used car, make sure to request the vehicle’s history report, arrange for a third-party inspection, pay attention to noise levels, and check suspension comfort. These steps will help you make an informed decision about the purchase. Additionally, during the test drive, ensure smooth gear shifting and listen for any unusual noises. Taking these precautions can save you from potential headaches and costly repairs down the road.

What are some routine maintenance tasks necessary for maintaining a vehicle’s performance?

To maintain your vehicle’s performance, it’s important to regularly perform oil changes, tire rotations, and brake cleanings and adjustments. This helps ensure the longevity and efficiency of your car.

cars for sale, auto financing, car loans, auto loan, auto financing in Akron, used cars near me